Advertisement

-

Published Date

September 5, 2020This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

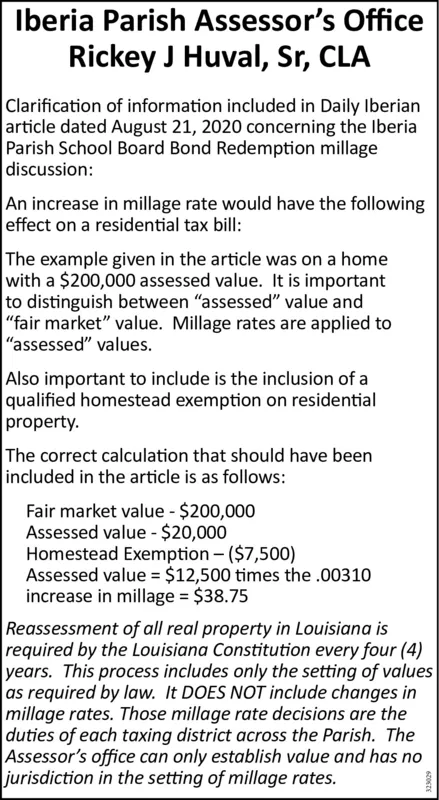

Iberia Parish Assessor's Office Rickey J Huval, Sr, CLA Clarification of information included in Daily Iberian article dated August 21, 2020 concerning the Iberia Parish School Board Bond Redemption millage discussion: An increase in millage rate would have the following effect on a residential tax bill: The example given in the article was on a home with a $200,000 assessed value. It is important to distinguish between "assessed" value and "fair market" value. Millage rates are applied to "assessed" values. Also important to include is the inclusion of a qualified homestead exemption on residential property. The correct calculation that should have been included in the article is as follows: Fair market value - $200,000 Assessed value - $20,000 Homestead Exemption - ($7,500) Assessed value = $12,500 times the .00310 increase in millage = $38.75 Reassessment of all real property in Louisiana is required by the Louisiana Constitution every four (4) years. This process includes only the setting of values as required by law. It DOES NOT include changes in millage rates. Those millage rate decisions are the duties of each taxing district across the Parish. The Assessor's office can only establish value and has no jurisdiction in the setting of millage rates. Iberia Parish Assessor's Office Rickey J Huval, Sr, CLA Clarification of information included in Daily Iberian article dated August 21, 2020 concerning the Iberia Parish School Board Bond Redemption millage discussion: An increase in millage rate would have the following effect on a residential tax bill: The example given in the article was on a home with a $200,000 assessed value. It is important to distinguish between "assessed" value and "fair market" value. Millage rates are applied to "assessed" values. Also important to include is the inclusion of a qualified homestead exemption on residential property. The correct calculation that should have been included in the article is as follows: Fair market value - $200,000 Assessed value - $20,000 Homestead Exemption - ($7,500) Assessed value = $12,500 times the .00310 increase in millage = $38.75 Reassessment of all real property in Louisiana is required by the Louisiana Constitution every four (4) years. This process includes only the setting of values as required by law. It DOES NOT include changes in millage rates. Those millage rate decisions are the duties of each taxing district across the Parish. The Assessor's office can only establish value and has no jurisdiction in the setting of millage rates.